Life Insurance in and around Saint Louis

Get insured for what matters to you

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

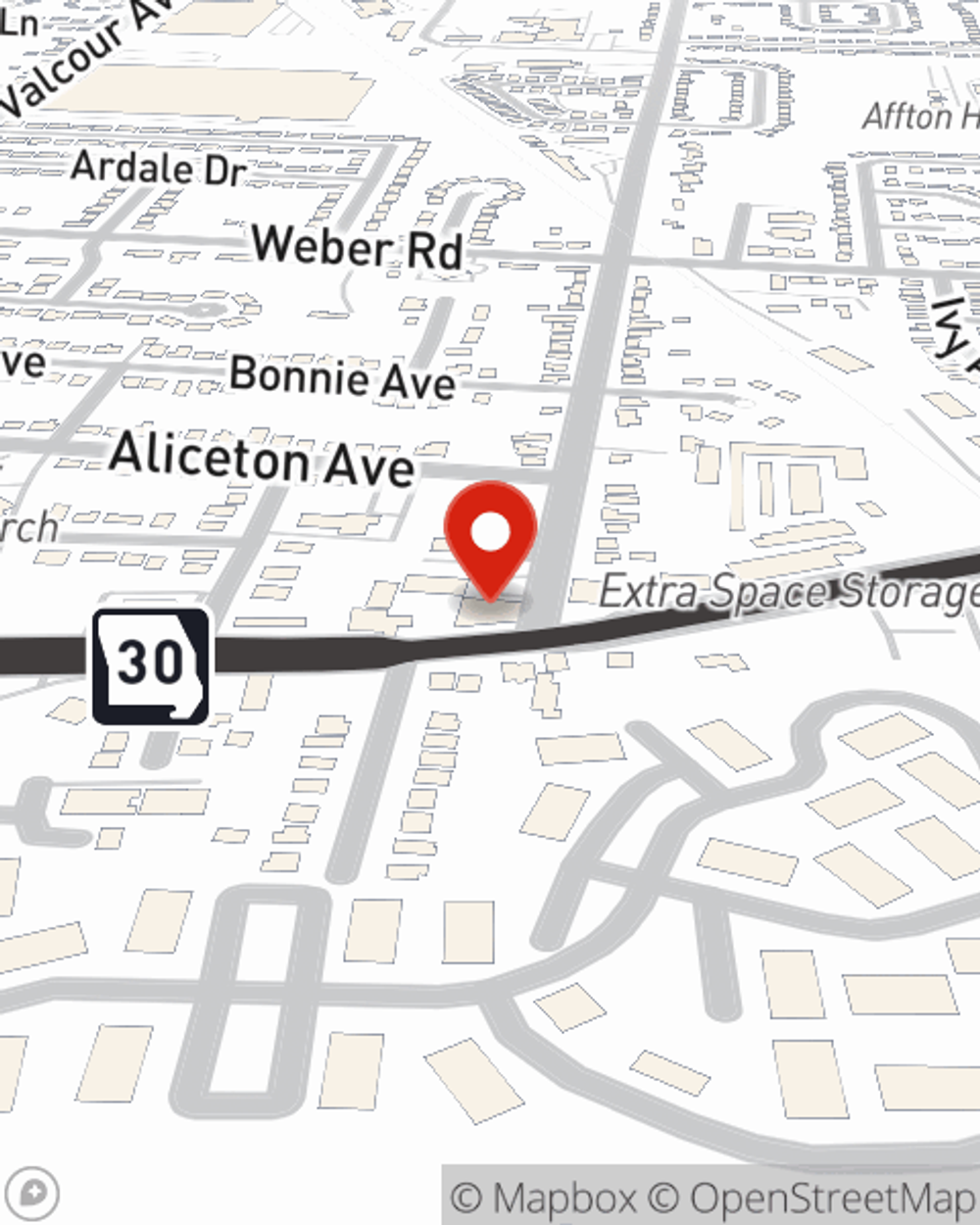

- Affton, MO

- Lemay, MO

- South County STL

- STL South City

- Crestwood, MO

- Sunset Hills, MO

- Fenton, MO

- Webster Groves, MO

- St. Louis City

- Shrewsbury, MO

- The Hill St. Louis

- Oakville, MO

- Mehlville, MO

State Farm Offers Life Insurance Options, Too

When facing the loss of your spouse or a family member, grief can be overwhelming. Regular day-to-day life halts as you prepare for arrange for burial funeral services, and face life without the one you love.

Get insured for what matters to you

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

Having the right life insurance coverage can help loss be a bit less complicated for the people you're closest to and provide space to grieve. It can also help cover matters like grocery bills, childcare costs and home repair costs.

With dependable, compassionate service, State Farm agent Dane Huxel can help you make sure you and your loved ones have coverage if life doesn't go right. Call or email Dane Huxel's office now to see the options that are right for you.

Have More Questions About Life Insurance?

Call Dane at (314) 631-1800 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.